|

pet health insurance immediate coverage: a fair cost-vs-benefit comparison"Immediate" sounds comforting, but it's not magic. The value depends on how quickly eligibility starts, what it includes, and what you'll still pay out-of-pocket. This guide compares the trade-offs so you can judge the headline promise against the numbers. What "immediate" usually meansIt typically refers to eligibility for certain claims right after the policy start time, not instant payouts. You still pay the vet and file a claim. - Accidents: some plans allow same-day eligibility once the policy activates; others use short waits (often 1 - 3 days).

- Illnesses: commonly have a longer wait (for example, 2 - 15 days), regardless of the "immediate" label.

- Orthopedic or bilateral issues: frequently carry extended waits (often months) unless specific exams or waivers are completed.

Costs vs benefits at a glance- Premiums: faster accident eligibility can raise rates slightly, especially in high-claim neighborhoods.

- Deductible and reimbursement: lower deductibles amplify early-claim value but cost more monthly; an 80 - 90% reimbursement looks generous yet still leaves your deductible and the remainder.

- Claim reality: reimbursement happens after review; immediate coverage means you're eligible to claim, not that money arrives at checkout.

- Exclusions and caps: exam fees, prescription diets, breeding care, and pre-existing issues are often excluded or optional; annual or per-incident caps can blunt the benefit.

Real-world momentFriday at 7:40 p.m., your Lab swallows a sock. You bought a policy at lunch after your coworker's scare. The provider confirms accidents are eligible starting at policy activation. The ER bill totals $2,100. With 80% reimbursement and a $250 deductible, you expect roughly $1,480 back after processing - though the exam fee may not count, depending on your plan. Comparison guide: who tends to gain vs pay more- Puppies/kittens prone to mishaps: high early benefit from accident eligibility; premiums are usually moderate, and incident frequency is higher.

- Older pets with known issues: strong protection for new accidents, but illnesses linked to prior symptoms often remain excluded.

- Active lifestyles: hikers, beachgoers, urban walkers - same-day accident eligibility is valuable for cuts, ingestions, and porcupine quills.

- Budget-sensitive owners: pairing a higher deductible with immediate accident eligibility can keep premiums manageable while guarding against large ER shocks.

How to evaluate "immediate" offers fairly- Verify the exact policy start time; some begin at 12:01 a.m. the next day, not at purchase.

- Compare waiting periods separately for accidents, illnesses, and orthopedic conditions.

- Check whether exam fees, after-hours surcharges, and prescriptions require add-ons.

- Measure annual, per-incident, and lifetime caps; quick eligibility matters less if caps are tight.

- Review claim submission, typical processing times, and any direct-pay arrangements (uncommon, clinic-dependent).

- Most policies allow any licensed vet; referrals are rarely required.

Pragmatic caveatImmediate coverage won't override pre-existing conditions or retroactively cover symptoms noted before the start date. If records show prior signs - even without a formal diagnosis - expect exclusions, and don't count on backdating. Edge conditions that trip people up- Cruciate injuries and hip dysplasia: often long waits or special orthopedic exams.

- Bilateral clauses: a problem in one eye or limb can exclude the same issue on the other side later.

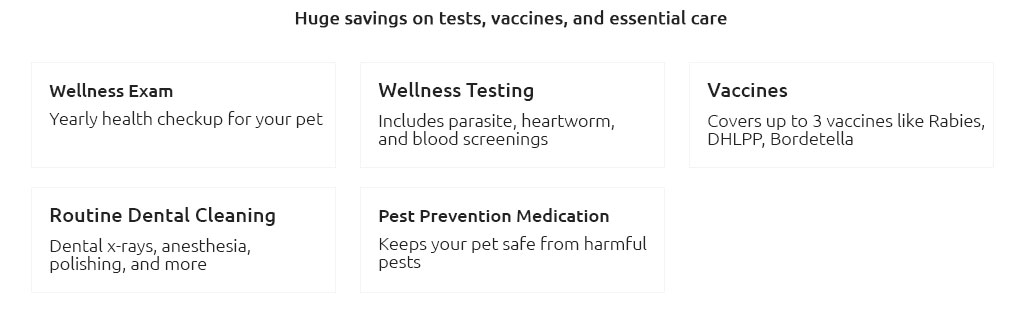

- Wellness add-ons: may start right away but cover preventive care, not emergencies.

Bottom lineImmediate eligibility can be worth it if near-term accident risk looms and you can front the vet bill while claims process. If premiums climb for that feature, compare a standard plan with a slightly lower deductible. Stay focused on definitions, waiting periods, and math - not just the word "immediate."

|

|